Understanding the Goods and Services Tax (GST) on hotel rooms is crucial for HR managers and travel administrators who frequently book accommodations for business trips. The implementation of GST in India has transformed the hospitality sector, introducing a streamlined tax structure that affects how hotel services are billed. As of July 18, 2022, the GST on hotel rooms is categorised based on the declared tariff, which determines the applicable hotel GST rate. For rooms priced below ₹1,000 per day, GST is 12%, while those priced between ₹1,000 and ₹7,500 incur a GST of 12%, and rooms costing more than ₹7,500 are subjected to an 18% GST rate.

Table of Contents

ToggleTravel administrators and HR managers must know these rates, as they directly impact travel budgets and expense reporting. The clarity provided by GST has simplified billing processes, ensuring that travellers can easily understand the taxes applied to their hotel stays. Furthermore, businesses can claim Input Tax Credit (ITC) on GST paid for hotel accommodations, provided the hotel is in the same state as the company’s GST registration. This reduces the overall cost of business travel and allows companies to manage their travel expenses more effectively.

In this comprehensive guide, we will delve deeper into the nuances of GST on hotel rooms, exploring the implications for travel administrators and providing insights on navigating the complexities of hotel GST rates.

Hospitality and Tourism Under Pre-GST

Before the introduction of the Goods and Services Tax (GST), India’s hospitality and tourism sector was subject to a complex web of taxes, including Value Added Tax (VAT), Service Tax, and Luxury Tax, among others. This fragmented tax structure varied across states, leading to a lack of uniformity in tax rates and compliance requirements.

Businesses in the hospitality industry, such as hotels and restaurants, had to navigate through multiple taxes, making compliance challenging and increasing business transaction costs. For instance, Service Tax was levied on services like room rentals and restaurant services, while VAT was applied to the supply of food and beverages. Luxury Tax, imposed by state governments, varied significantly, adding another layer of complexity.

The absence of uniform tax rates across the country resulted in inefficiencies and discrepancies in pricing, making it difficult for consumers to understand the final cost of services. Businesses had to manage separate compliance requirements for different taxes, necessitating extensive bookkeeping and increasing the administrative burden.

The pre-GST tax regime in the hospitality and tourism sector was complex and high-cost for businesses and customers. The lack of Input Tax Credits (ITC) on certain taxes meant businesses could not offset the tax paid on inputs against their output tax liability, further escalating costs.

The introduction of GST aimed to simplify this landscape by consolidating multiple taxes into a single, uniform tax structure, thereby improving business compliance and reducing costs

Post GST Rates of Hospitality and Tourism

Implementing the Goods and Services Tax (GST) in India has significantly transformed the hospitality and tourism sector by simplifying the tax structure and providing clarity on applicable rates. Under the post-GST regime, hotel services are taxed based on the room tariff, which has streamlined the billing process and enhanced transparency for travel administrators.

The GST on hotel rooms is categorised into four distinct tiers based on the nightly room tariff:

| Room Tariff Per Night | GST Rates |

| ≤ ₹1,000 to ₹7,500 | 12% |

| ₹7,501 and above | 18% |

*New GST rates as of 2023, incorporated.

This tiered structure promotes budget accommodations while ensuring luxury hotels contribute a higher tax rate. For instance, a room priced at ₹4,000 falls under the 12% GST category, while a luxury suite costing ₹10,000 incurs an 18% GST rate. This differentiation can lead to price disparities, particularly during peak seasons when hotels adjust their rates based on demand.

-

Implications for Travel Administrators

Understanding the GST on hotel rooms is essential for effective budget management and expense reporting for travel administrators. The ability to claim an Input Tax Credit (ITC) on GST paid for hotel accommodations allows businesses to offset the tax against their output GST liability, effectively reducing the overall cost of travel. This is particularly beneficial for companies that frequently book rooms for employees, as it allows for better financial planning and resource allocation.

However, the hospitality industry has advocated for a uniform GST rate of 12% across all hotel categories to simplify compliance and reduce the administrative burden on businesses. Currently, the tiered GST system can lead to confusion and inconsistencies in pricing, which may deter potential travellers from booking accommodations.

The post-GST landscape for the hospitality and tourism sector has introduced a more organised and transparent tax structure. While the tiered GST rates aim to accommodate various market segments, there is an ongoing discussion about the potential benefits of a uniform GST rate to enhance competitiveness and attract more domestic and international travellers. Understanding these rates is crucial for travel administrators and HR managers to navigate the complexities of travel expenses effectively.

Advantages of GST on Hotel Rooms

Implementing the Goods and Services Tax (GST) in India has brought several advantages for the hospitality sector, particularly regarding hotel room taxation. GST has simplified compliance and enhanced transparency for businesses and consumers by consolidating multiple taxes into a uniform structure.

Let’s explore some of the key advantages of GST on hotel rooms:

-

Uniform Tax Structure

Before GST, the hospitality industry was subject to a complex web of taxes, including Service Tax, Value Added Tax (VAT), and Luxury Tax, which varied across states. The introduction of GST has eliminated this fragmented system, replacing it with a uniform tax structure across the country. This simplification has made it easier for hotels to comply with tax regulations and reduced the administrative burden of managing multiple taxes.

-

Clarity for Consumers

Under the pre-GST regime, it was often difficult for consumers to differentiate between VAT and entertainment tax. However, with the implementation of GST, customers now see a single charge on their hotel bills, providing them with a clear understanding of the tax they are paying. This increased transparency has enhanced consumer confidence and made comparing prices across different hotels easier.

-

Availability of Input Tax Credit

One significant advantage of GST for the hospitality industry is the availability of Input Tax Credit (ITC). Under the GST system, hotels can claim ITC on various goods and services used in the course of their business, such as furniture, cleaning supplies, and food ingredients. This has helped to reduce hotels’ overall tax liability and enabled them to pass on the cost savings to consumers in the form of lower room tariffs.

-

Streamlined Billing Process

The simplification of the tax structure under GST has also led to a more efficient billing process for hotels. With only one tax to compute, the check-out process has become faster and more convenient for guests. This has improved the overall customer experience and helped hotels enhance service quality.

The advantages of GST on hotel rooms are multifaceted, ranging from simplified compliance and enhanced transparency to streamlined billing processes and the potential for industry growth. As the hospitality sector adapts to the new tax regime, it will likely reap the benefits of a more efficient and equitable taxation system.

Disadvantages of GST on Hotel Rooms

While implementing the Goods and Services Tax (GST) has brought numerous advantages to the hospitality sector, it has also introduced several challenges and disadvantages that travel administrators and hotel operators must navigate. Understanding these drawbacks is essential for making informed travel expenses and budgeting decisions.

-

Increased Costs for Travelers

One of the most significant disadvantages of GST on hotel rooms is the potential increase in accommodation costs for travellers. Before GST, many budget hotels charged minimal taxes, especially for rooms priced below ₹1,000, which were often exempt from taxes. However, under the current GST framework, even budget accommodations are subjected to a tax rate of 12% for rooms priced between ₹1,000 and ₹7,500. This change has raised the overall cost of stays, making it more expensive for corporate travel administrators, particularly those who frequently book budget options.

-

Complexity in Compliance for Hoteliers

Although GST aims to simplify the tax structure, it has also introduced complexities for hotel operators. Hoteliers must now maintain detailed records to ensure compliance with GST regulations, which can be burdensome, especially for smaller establishments. A survey indicated that 73.33% of hoteliers faced technical issues related to IT systems necessary for GST compliance, highlighting the challenges in adapting to the new tax framework. Additionally, the frequent changes in GST laws can lead to confusion and errors, resulting in potential penalties for non-compliance.

-

Input Tax Credit Limitations

While GST allows for claiming Input Tax Credit (ITC), some limitations can affect hotel operators. For instance, hotels cannot claim ITC on specific expenses related to employee welfare or personal consumption. This restriction can limit the financial benefits that hotels could otherwise leverage to reduce operational costs. Moreover, corporate travel administrators cannot claim ITC on GST paid for hotel rooms, as they are not engaged in providing accommodation services, further complicating budgeting for business trips.

-

Impact on Pricing Strategies

The tiered GST rates based on room tariffs can lead to pricing inconsistencies across the hospitality sector. Hotels may feel pressured to adjust their pricing strategies to remain competitive, resulting in fluctuating rates that confuse consumers. For example, a hotel might increase its room rates to offset the higher GST burden, leading to unpredictable corporate travel costs. This unpredictability can complicate travel budgeting and expense reporting for businesses.

While GST on hotel rooms aims to streamline the tax structure and improve compliance, it also presents several disadvantages for travellers and hotel operators. Increased costs, compliance complexities, limitations on Input Tax Credit, and impacts on pricing strategies are vital concerns that must be addressed. Travel administrators should remain vigilant and informed about these challenges to effectively manage their travel expenses and make strategic decisions regarding hotel accommodations.

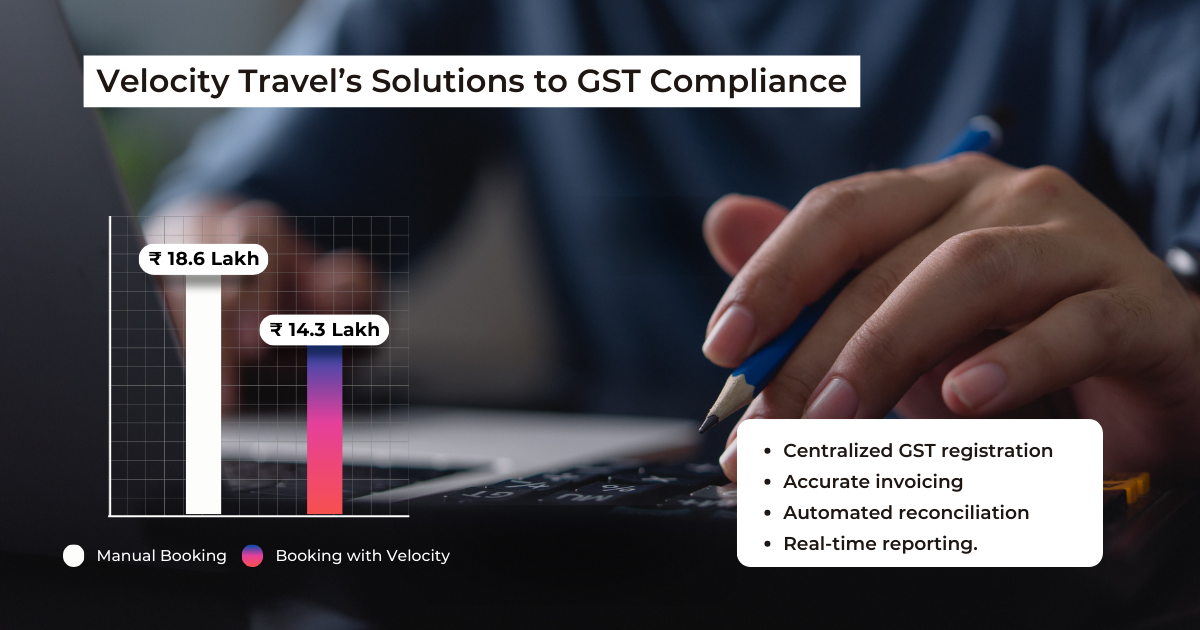

How Velocity Travel Simplifies Corporate Travel Management?

Velocity Travel is dedicated to simplifying corporate travel management for businesses. We address the challenges faced by corporate travel administrators and HR managers regarding Hotel GST compliance and governance. Here’s how we provide effective solutions tailored to these specific needs:

The Hotel GST Problem

Corporate travel often involves multiple hotel bookings across various states, each with its own GST regulations. The complexities arise from:

- GST Registration Requirements: Companies must be registered in each state where they book hotels to claim Input Tax Credit (ITC) on GST paid.

- Invoice Management: Errors in hotel invoices can lead to difficulties in claiming ITC, resulting in financial losses.

- Manual Reconciliation: The need for manual checks increases the workload on finance teams, leading to inefficiencies and potential errors.

Velocity Travel’s Solutions

-

Streamlined GST Compliance

Velocity Travel ensures that all hotel bookings are compliant with GST regulations. We assist corporate clients in:

- Centralised GST Registration: We help clients navigate the registration process across different states, ensuring they can claim ITC effectively.

- Accurate Invoicing: Our system generates standardised invoices that minimise errors, making it easier for clients to manage their tax liabilities.

-

Maximising Input Tax Credit (ITC)

We focus on maximising the benefits of ITC for our corporate clients by:

- Optimised Booking Processes: By consolidating bookings through our platform, we ensure that all transactions are eligible for ITC, adhering to the applicable GST rates (5% or 18%, depending on the conditions).

- Expert Guidance: Our team provides insights into which bookings are eligible for ITC and how to document them correctly, reducing the risk of non-compliance.

-

Automated Reconciliation

Velocity Travel employs technology to streamline the reconciliation process:

- E-Invoicing Solutions: We utilise e-invoicing systems that automatically verify invoices against GST portal requirements, reducing manual effort and errors.

- Real-Time Reporting: Our platform offers real-time tracking of GST liabilities and ITC claims, enabling corporate travel administrators to maintain accurate records effortlessly.

-

Dedicated Support

Our commitment to customer service includes the following:

- 24/7 Assistance: Corporate clients can access round-the-clock support for queries about GST or travel arrangements.

- Training and Resources: We provide training sessions for HR managers and travel administrators on GST compliance and best practices for managing hotel bookings.

Velocity Travel is dedicated to solving the Hotel GST problem for corporate travel administrators and HR managers. We empower organisations to manage their travel expenses effectively while ensuring adherence to tax regulations. This enhances operational efficiency and contributes positively to the overall travel experience for employees.

Conclusion

The implementation of the Goods and Services Tax (GST) has brought about significant changes in the taxation system for the hotel industry in India. While customers have benefited from the uniformity in taxation, hoteliers have had to adjust their prices and comply with the new tax regulations. The impact of GST on the hotel industry is still evolving, and it remains to be seen how the industry will adapt to the new tax system in the future.

The introduction of GST has brought about significant changes in the hotel industry, affecting customers and hoteliers. While the new tax system has increased prices for luxury hotels, it has also brought about uniformity in taxation and reduced the administrative burden for hoteliers. As the industry continues to adapt to the new tax system, the impact of GST will likely continue to evolve in the coming years.

FAQs on GST for Hotel Rooms

How much is GST on a hotel room?

The GST on hotel rooms varies based on the room tariff. As of October 18, 2022, the applicable rates are as follows:

- Rooms priced below ₹1,000: 12% GST

- Rooms priced between ₹1,000 and ₹7,500: 12% GST

- Rooms priced above ₹7,500: 18% GST

What is the GST on hotel rooms in 2024?

As of 2024, the GST rates on hotel rooms remain the same as established in 2022. The tiered structure continues to apply, with rates of 12% below ₹7,500 and 18% above ₹7,500 room tariff.

How do you calculate GST on a hotel bill?

To calculate GST in a hotel bill, follow these steps:

- Determine the room tariff.

- Identify the applicable GST rate based on the tariff.

- Multiply the room tariff by the GST rate to find the GST amount.

- Add the GST amount to the room tariff to get the total bill.

For example, for a room tariff of ₹4,000, the GST would be calculated as follows:

- GST = ₹4,000 × 12% = ₹480

- Total Bill = ₹4,000 + ₹480 = ₹4,480 .

Can I claim GST on hotel stays?

Corporate travel administrators can claim Input Tax Credit (ITC) on GST paid for hotel accommodations if the hotel is registered in the same state as the business and the stay is for business purposes. However, individuals cannot claim GST on personal stays.

Are some hotel rooms’ GST rates exempted?

No. Even hotel rooms priced less than INR 1,000 per night are now taxed 12% GST, as opposed to the previous exemption.